Now he wants to turn off factories to save his industry – El diario andino

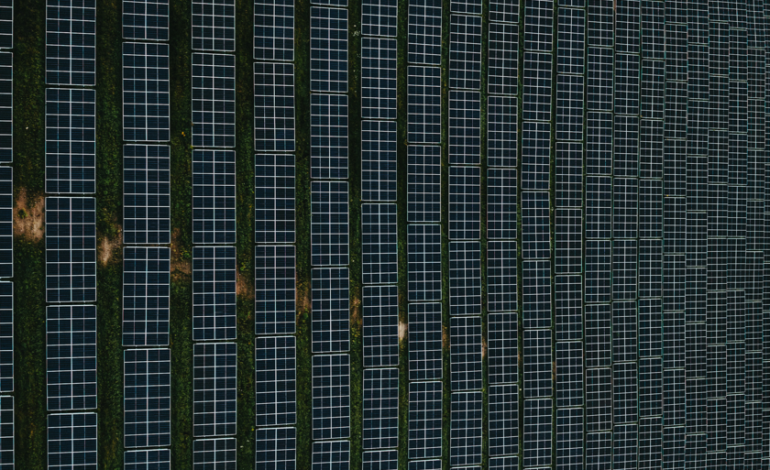

China is the undisputed leader of worldwide solar energy. Its factories produce almost 90% of the solar cells of the planet and have left European and American competitors out of play. But that overwhelming domain has resulted in a monumental problem: prices for soils, millionaire losses and an excess of panels that the world does not need. Now Beijing prepares a shock plan to «reset» its solar industry.

The solar bubble exploded. Between 2020 and 2023, Beijing redirected resources from the real estate sector to what he baptized as «the three new growth industries»: solar panels, electric cars and batteries. The result resulted in a flood of factories and an unprecedented production. In a report for Financial Timesthe Asian giant has registered a manufacture of 588 GW of solar cells last year, more than double the 451GW world demand.

The immediate consequence was a price collapse: companies sold below cost to release stock, which caused losses with more than 60,000 million dollars. The solar grade polisilicio – key premium material – sank up to about 50 yuan per kilo. In addition, the social impact was not less. The five largest photovoltaic companies reduced their templates by 31 %, which represents 87,000 silent dismissals.

Of success to venom. The diagnosis is clear: excess capacity and wild competence. What once was the recipe of success – hipercompetitiveness and mass production – has ended in a downward race. Bo Zhengyuan analyst He explained it at FT: «That same ‘animal spirit’ that succeeded in industry is now destroying it.»

In addition, the state strategy played a central role. The central government encouraged factories and solar parks as a growth engine, while provincial governments, evaluated by employment and production, resisted any closure of deficit plants.

The self -regulation attempt did not work either. In 2024, giants such as Longi, Tongwei and Ja Solar signed a «self -discipline» pact to limit production, imitating oil OPEC. But the agreement was not binding, and while some expected others to fulfill, many increased their production further to gain market share. The result was the opposite: historical excess of supply and sunken balances.

Beijing’s plan. With the sector in red numbers, Beijing has decided to intervene. According to Bloomberglarge producers, with state support, plan a fund of at least 50,000 million yuan (7,000 million dollars) to acquire and close more than one million tons of polysilicio capacity.

The movement seeks an immediate objective: stabilize prices. Ming Yang, Financial Director of Daqo New Energy, has declared Bloomberg that the sector «already touched background» and should return to profitability before the end of the year. His words were enough for solar actions to shoot: Daqo rose 14 % in Shanghai and the sector dominated the highest increases in the CSI 300 index.

In parallel, Gcl Technology proposed to close a third of the industry’s capacity. Its financial director He has recognized Reuters There are no guarantees that the reform is implemented this year, but acknowledged that Spot prices have already begun to rise after the signal of regulators to curb “excessively low” sales.

For its part, the Ministry of Industry has summoned executives from 14 companies to demand the closure of underutilized factories and promised stricter controls on new environmental projects and requirements, As Financial Times has pointed out.

A geopolitical and technological dilemma. The Chinese solar reset not only has an economic, but also political and geostrategic dimension. According to FTon the one hand, the avalanche of cheap exports has tensed relations with the United States and Europe, while Beijing continues to promote sales to developing countries within its Strip and Route initiative.

On the other hand, the sector has not stopped its technological commitment. Despite the losses, the six largest companies invested 3.4 billion yuan in R&D in the first half of 2025 and maintain almost 17,000 employees dedicated to research. In just five years, the conversion efficiency of solar cells has gone from 20 % to 30 %, According to UBS cited in the British media.

But the paradox persists: analysts estimate that it should be eliminated between 20% and 30% of the production capacity for companies to be profitable again. An adjustment of this caliber collides with the interests of the provincial governments, which depend on local employment and investment, which complicates the execution of the plan.

The light and the shadow of leadership. China built its solar hegemony with speed, scale and low prices. That same recipe today with destroying it. The country faces an uncomfortable decision: let the ultra -opening continue to sink its champions or assume a painful adjustment that closes factories and entertain prices.

«In no other sector dominate more than in this one,» Economist Alicia García-Herrero has warned FT. Precisely because of that, Beijing seems willing to reset his sun, although it hurts. Only in this way can it prevent its greatest success story from becoming another victim of its own excess.

Image | Unspash

| China broke the solar panel market. Now their companies have had to say goodbye to a third of their employees